Question of the Day: Are Stocks A Risky Long-Term Investment?

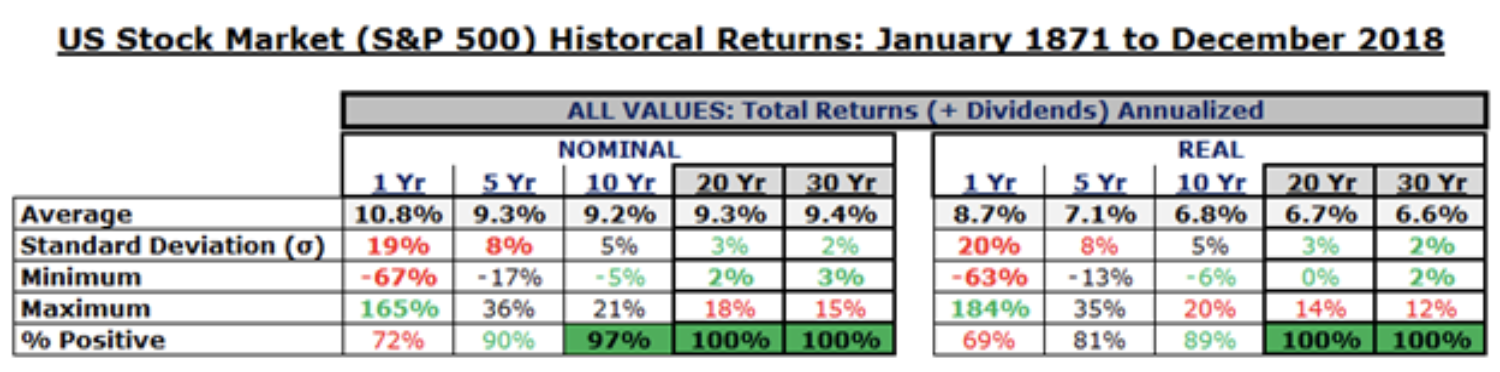

Check out the returns from the S&P 500 over rolling 5, 10, 20, and 30 year periods.

Questions:

- Investment gurus often say that “you should invest for the long-term.” Do you agree or disagree with that statement based on the data you see in this chart about long-term stock market returns?

- As an investor, do you think you would have the fortitude to remain invested even when seeing loss during a bear market?

- Will investors be satisfied just earning the market return (this chart is based on the performance of the S&P500)?

Behind the numbers (Capital Advisors Ltd.):

"A few things stick out:

- Over longer periods of time (20 and 30 years) the stock market has generated nominal returns of about 9% and real returns of about 6.5%.

- There has not been a time historically when stocks have had a negative nominal or real rate of return over longer periods of time (20 and 30 years).

- Further, the volatility of stock market returns become more stable as time goes on as the volatility (as measured by standard deviation) decreases."

----------------

Dig deeper with the NGPF Data Crunch: Are Stocks a Risky Long-Term Investment?

----------------

To receive a Question of the Day in your email inbox, subscribe to the NGPF Blog.

About the Author

Mason Butts

After graduating from UCLA with a Master's in Education, Mason spent 5 years as a science educator in a South Los Angeles public high school. He is committed to supporting the holistic growth of all students and empowering them to live a life of relational, academic, and financial success. Now settled in the Bay Area, Mason enjoys facilitating professional developments and partnering with educators as they prepare students for a bright financial future. When Mason is not building curriculum or planning a training, he can be found cycling, trying new foods, and exploring the outdoors.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox: