MATH MONDAY: Compound Interest

In the last two Math Mondays, we covered exponential growth and decay. This week, we’re shifting slightly to exponential functions’ fun neighbor - compound interest.

Compound interest is a rich topic with abundant real-world applications. Today, we’ll highlight three fun classroom activities that will help your students master compound interest, followed by some additional extension activities.

Activity 1: Compound Interest in Savings Accounts

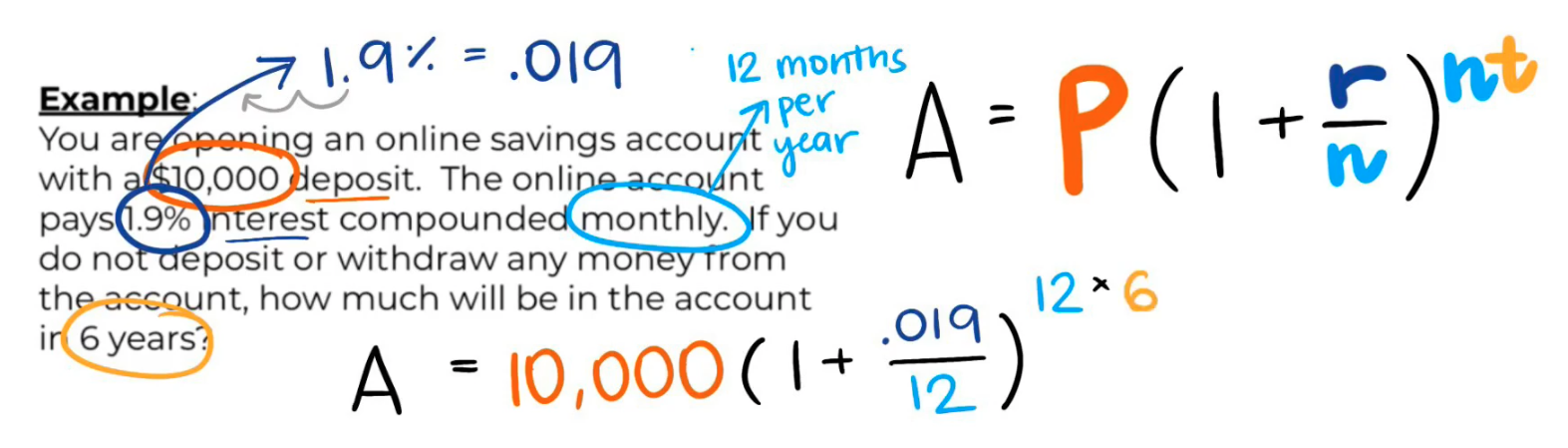

The lesson MATH: Compound Interest in Savings Accounts is a perfect place to start teaching compound interest. Students are introduced to the compound interest formula, practice applying it to different savings accounts, and analyze how the frequency of compounding impacts the final amount.

Activity 2:

Game time! In Compounding Cat Insanity, your student will put their fast-clicking skills to the test as they try to feed their ever-growing hoard of hungry cats, all while building conceptual understanding of compound interest.

Each cat has a different “interest rate”, which students can compare in an additional bonus level after they’ve completed the game once. Budget about 5 minutes for the game, and be sure to check out the accompanying worksheet!

Activity 3:

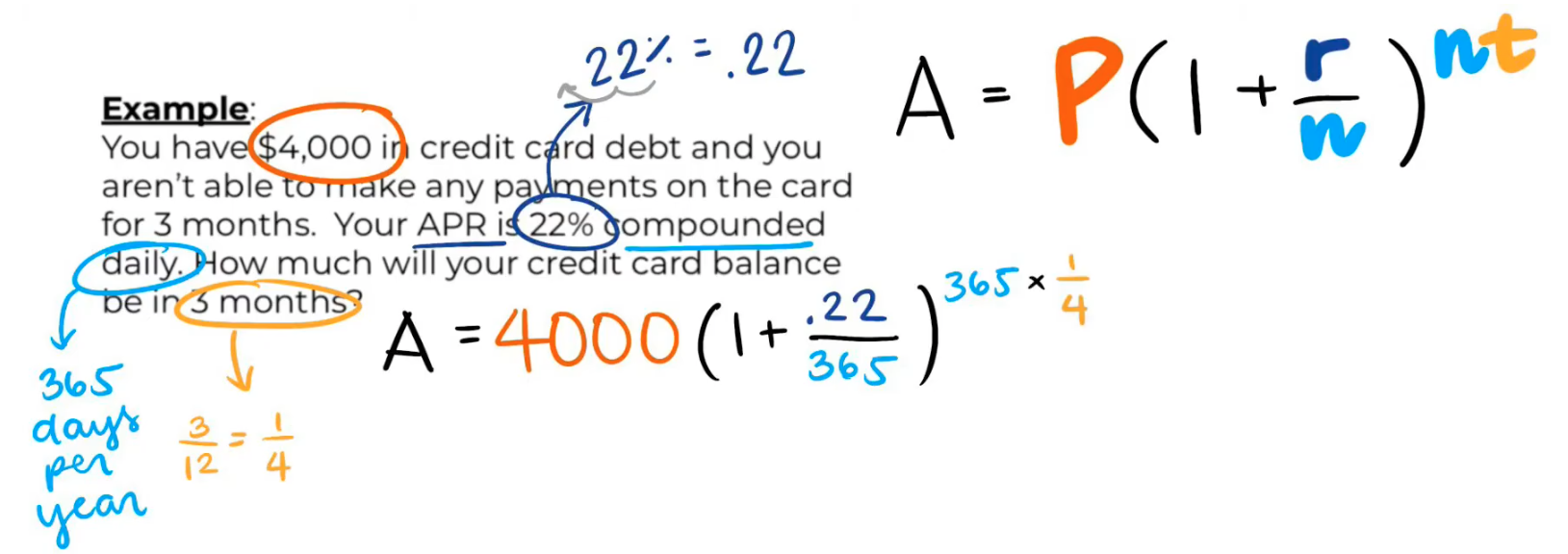

A perfect pairing with Cat Insanity, MATH: Compound Interest Pitfalls teaches students to calculate how compound interest will accrue on an unpaid credit card bill!

Students who are familiar with the compound interest formula can jump right into practicing with real-world problems. For students who need a refresher, the Edpuzzle video breaks down every step of using the compound interest formula, including common places where students trip up, like converting units and order of operations.

Building Engagement and Conceptual Understanding: Here are some ways you can supplement and differentiate this activity.

- MATH: The Cost of Minimum Payments: Students use amortization tables to discover the impact of compound interest, without using the formula.

- INTERACTIVE: The Power of Compounding: Students use a compound interest calculator to compare three different savings and investing outcomes.

Extend the Personal Finance Learning: If you’re a math teacher, consider using these resources to learn more about personal finance and continue making real-world connections in math!

- DATA CRUNCH: What Interest Rates Do Consumers Pay on Their Credit Cards? By NGPF

- ANALYZE: Investing for Retirement by NGPF

- CALCULATE: High Rate vs Debt Snowball by NGPF

- INFOGRAPHIC: Compound Interest by Napkin Finance

- VIDEO: Investing Basics: The Power of Compounding by TD Ameritrade

For Your Learning: Check out our On-Demand MATH PD about compound interest. You can view our entire math collection here.

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox: