Interactive: Laws on Minor Bank Accounts by State

I didn’t spend much time considering the implications of payroll card fees until five or six years ago when one of my students showed me that she had spent over $50 in three months to access her own money and check her account balance. This is significant for a kid earning minimum wage and trying to help her mother pay the bills. She wanted a bank account, but her mother was unbanked. Have a look at some of the fees that payroll cards might charge, taking the E1 Visa® Payroll Card as an example.

in 2017, there were an estimated 5.9 million active cards with $42 billion in load value, numbers which had doubled since 2010. By 2022, those figures are expected to jump to 8.4 million and $60 billion, according to an industry estimate from payments consulting firm Aite Group. A 2018 study from CFSI (now the Financial Health Network) found that relative to the population of working Americans, payroll card users tend to be younger, occupy lower-income brackets, and have higher representation from certain communities of color.

I was fortunate enough to work with a community bank willing to establish minor bank accounts for students, oftentimes referred to as non-custodial accounts. This allows students who did not have custodians (family members) who were banked to open bank accounts without a custodian. The accounts were very similar to Bank On accounts, low/no fee bank accounts that are safe to use. Students could now have paychecks directly deposited into these accounts, and employers can no longer require employees to use payroll cards.

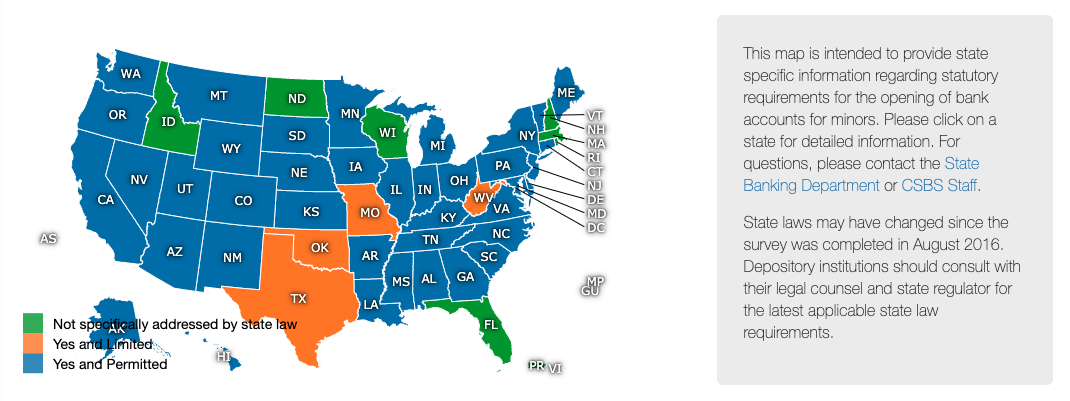

This map is intended to provide state-specific information regarding statutory requirements for the opening of bank accounts for minors. Please click on a state for detailed information.

What can you do if you have students facing similar circumstances?

- Use the interactive above to see what the laws are for your state.

- If applicable, contact your local bank or credit union and inquire about a Bank On account or low/no fee non-custodial account.

- Share this information with your student(s), as well as this handy CFPB checklist to open a bank or credit union account.

Do you want to learn more new and safe banking products you can share with your students?

- Click here to register for the PD: Bank On (4/8/21) at 5:00 ET

- Click here to register for the PD: Bank On (4/20/21) at 4:00 ET

- Click here to register for Inclusive Financial Education: Unbanked and Underbanked Americans at our Virtual National Conference on 4/24/21

- Click here to access our Bank On Informational Handout

About the Author

Brian Page

Making a difference in the lives of students through financial capability is Brian’s greatest passion. He comes to NGPF after fifteen years of public school teaching where he was the ‘11 Ohio Department of Education recipient of a Milken National Educator Award, the CEE Forbes Award winner, and a Money Magazine/CNN "Money Hero". He served on the working group for President Obama's Advisory Council on Financial Capability. He has private school experience as a Trustee for the Cincinnati Country Day School and was a past Ohio Jump$tart President. Brian holds a BBA and M.Ed. When Brian isn’t working alongside his NGPF teammates he is likely spending time with his wife, three children, and dog; hiking, or watching Ohio State football.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox: