What is Bitcoin and How Does Cryptocurrency Work? (A Primer)

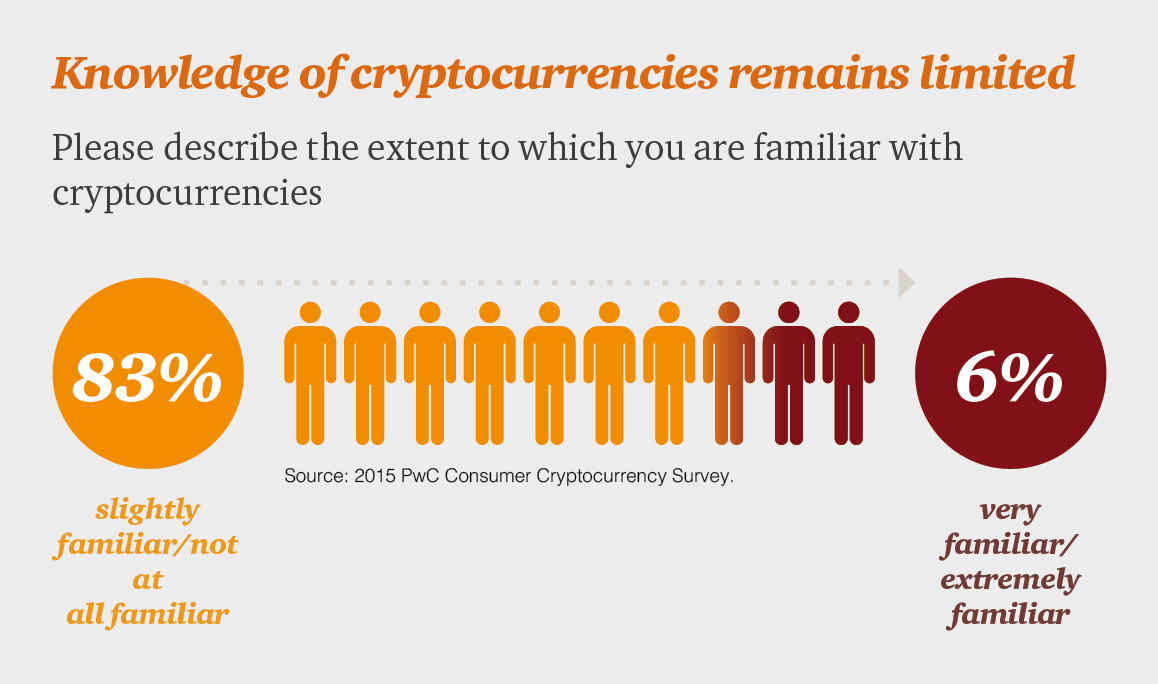

Recently, Bitcoin, the most famous of the cryptocurrencies, has soared to all-time highs (Fortune, May 2017), increasing the amount of press attention and internet searches (Google Trends, May 2017) surrounding the little-known digital currency. We’ve also heard this question from many of our users, “what is Bitcoin and what do my students need to know about cryptocurrencies”? You are not alone! 83% of respondents in a 2015 survey conducted by PwC were “slightly familiar/not at all familiar” with cryptocurrencies (PwC, August 2015).

Although a complex topic, we will attempt to shed some light through this brief primer:

Cryptocurrency Explained in One Paragraph: “Bitcoin is a new currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. Bitcoins [and other cryptocurrencies] can be used to buy merchandise anonymously. Transactions are made with no middle men – meaning, no banks! There are no transaction fees and no need to give your real name. More merchants are beginning to accept them. In addition, international payments are easy and cheap because bitcoins are not tied to any country or subject to regulation. Small businesses may like them because there are no credit card fees. Some people just buy bitcoins as an investment, hoping that they’ll go up in value.” (CNN Money)

What is Bitcoin (and how is it different from traditional currency)? Bitcoin and other cryptocurrencies, such as Litecoin, Ethereum, Zcash (Investopedia, 2017), are digital, de-centralized, and verified currencies.

- Digital: Let’s remember that money is a medium (whether physical cash or electronic) of exchange where both parties, the buyer and the seller, agree to the value of a transaction and money is that store of value. Cryptocurrencies work in a similar way in that they can be used as a medium of exchange, but instead of a physical exchange of money, they are a digital currency and all transactions occur over the internet.

- De-Centralized: “Unlike traditional currencies, which are issued by central banks, Bitcoin has no central monetary authority. Instead it is underpinned by a peer-to-peer computer network made up of its users’ machines, akin to the networks that underpin BitTorrent, a file-sharing system, and Skype, an audio, video and chat service. Bitcoins are mathematically generated as the computers in this network execute difficult number-crunching tasks, a procedure known as Bitcoin ‘mining’.” (Economist, April 2013). Traditional currencies are considered safe by buyers and sellers, because governments ensure counterfeit bills are not in circulation, but are exposed to macroeconomic risks related to the issuing country’s monetary policy. Assuming most people are holding traditional currencies as a medium of exchange to buy goods and services, and not as an investment vehicle, it would be great if they could guarantee the currency was not counterfeited while avoiding government-related currency risk. De-centralized cryptocurrencies provide this exact benefit.

- Verified: In the virtual world, it could be possible to “double spend”, or simultaneously use the same traditional currency to buy two different things, but the banking system, in coordination with the US government, performs the accounting to ensure this cannot happen. With cryptocurrencies, each transaction is stored in what is called the blockchain: “The blockchain protocol is the basis for a public decentralized ledger that records all bitcoin transactions and removes the financial middleman, allowing transactions to be settled within minutes. Each transaction is verified and validated [using complex mathematical calculations], resulting in ledger (or log) of these transactions that is public and transparent.” (Latham Watkins, 2015)

What Are Uses for Bitcoin?

- Paying for Goods and Services:

- Pros: Cryptocurrencies are private (secure, no personal information is needed unlike debit cards), fast (they settle immediately unlike personal checks that may take several days), inexpensive (transaction costs are 0-1%, because there is no governmental monitoring or regulation of the cryptocurrency, whereas credit card fees are typically 2.5% or higher) and global (no accounts domiciled in a specific country are needed) (Latham Watkins, 2015). More merchants, such as Microsoft, Overstock.com, Dell, Expedia, Subway, are accepting Bitcoin (99BitCoins, June 2016), including sports teams such as the MLS San Jose Earthquakes (SJ Earthquakes, June 2014).

- Pros: Cryptocurrencies are private (secure, no personal information is needed unlike debit cards), fast (they settle immediately unlike personal checks that may take several days), inexpensive (transaction costs are 0-1%, because there is no governmental monitoring or regulation of the cryptocurrency, whereas credit card fees are typically 2.5% or higher) and global (no accounts domiciled in a specific country are needed) (Latham Watkins, 2015). More merchants, such as Microsoft, Overstock.com, Dell, Expedia, Subway, are accepting Bitcoin (99BitCoins, June 2016), including sports teams such as the MLS San Jose Earthquakes (SJ Earthquakes, June 2014).

-

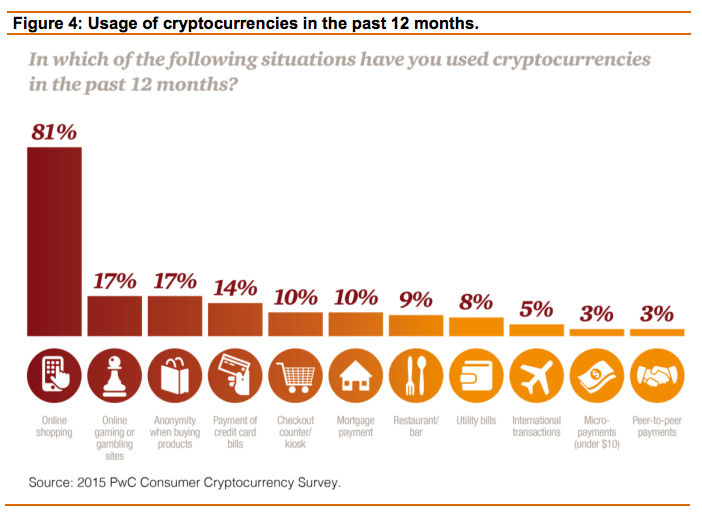

- Cons: Many buyers and sellers are unaware of, wary of money-laundering risks related to, or don’t fully understand cryptocurrencies and what causes changes in their value (PwC, 2015). The majority of merchants do not accept Bitcoin and those that do frequently partner with Bitcoin exchanges that immediately convert the cryptocurrency into traditional currency, suggesting current skepticism about the ability for cryptocurrencies to replace traditional currencies as a medium of exchange (Time, January 2015).

- Investments: In short, Bitcoin are traded in little-understood, highly-volatile markets, and thus should be avoided as a primary investment vehicle.

- High Volatility: Typically, the value of Bitcoin is quoted in relation to US Dollars, and just like with traditional currencies, this market rate can fluctuate. Over the last five years, Bitcoin has increased in value by an astounding 45,000% and it has gained 150% alone in 2017 (CNBC, May 2017). Temptations to pursue these mouth-watering returns should be tempered as there is tremendous volatility in the exchange rate of Bitcoin to USD, with the value reaching an all-time high (Fortune, May 2017) and subsequently falling 19% (CNBC, May 2017) all within three trading days. Uncertainty about the supply of and demand for Bitcoin largely contributes to this high volatility.

-

- Fluctuating Supply for Cryptocurrencies: “People compete to “mine” bitcoins using computers to solve complex math puzzles [as part of the verification and validation process described earlier]. This is how bitcoins are created” (CNN Money). Thus, the supply of Bitcoin in the world is constantly fluctuating as more computers are set-up to “mine”. Mathematically, there is a finite amount of 21 million Bitcoin that can be “mined”, which puts a cap on the money supply, in stark contrast to central-bank-backed traditional currencies (which can print more money).

-

- Fluctuating Demand for Cryptocurrencies: Demand for Bitcoin is incredibly volatile since the market is in a nascent stage. For example, there is speculation that recent large buying of Bitcoin by Asian investors is attributed to the recent rule changes in Japan where Bitcoin is now allowed to be used for online payments (CNBC, April 2017). This and other external events that can dramatically affect the demand for Bitcoin contribute to increased volatility in the spot exchange rate for cryptocurrencies.

-

- Future Hedge Against Inflation: While cryptocurrencies are largely a speculative investment, their de-centralized nature, whereby the supply is not controlled by a government, could potentially make them a good hedge, or risk management vehicle, against rising inflation or depreciation in the value of traditional currencies. For example, if there are widespread fears of depreciation in major currencies like USD, JPY or EUR, an investor may opt to hold Bitcoin in order to mitigate that risk.

Want to Learn More? Here are several resources that may be helpful for your students or you:

- What is Bitcoin? (CNN Money)

- Explain Bitcoin Like I’m Five (Medium, December 2013)

- How Does Bitcoin Work? (Economist, April 2013)

- Money is no object: Understanding the evolving cryptocurrency market (PwC, August 2015)

- Cryptocurrency, A Primer (Latham Watkins, 2015)

- Bitcoin and the Blockchain (Bloomberg QuickTake, March 2017)

- What is Bitcoin? All About the Mysterious Digital Currency (NY Times, May 2017)

About the Author

Hari Vasu-Devan

As a young Indian immigrant, Hari was extremely privileged to learn about financial literacy by way of his parents....

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS