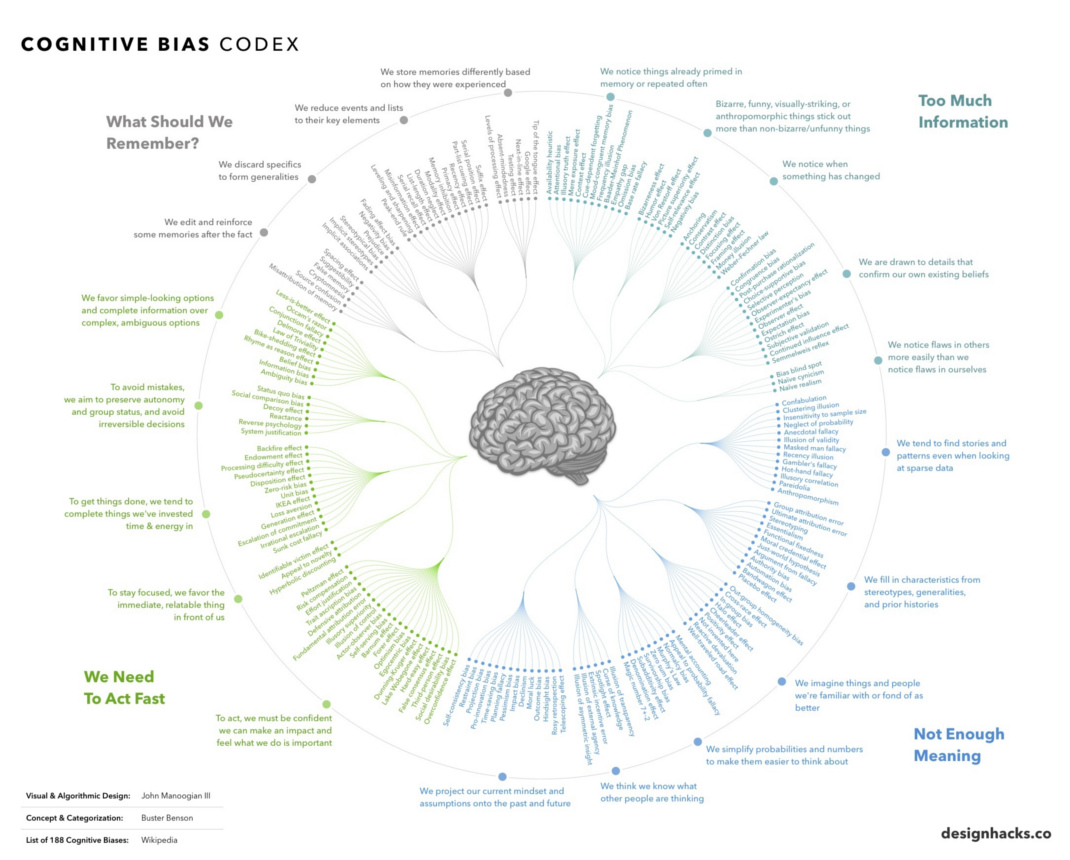

Chart: What Are The Mental Mistakes We Make And Why Do We Make Them?

Answer (from Visual Capitalist): There's a lot of them (and that's what makes us human). This chart shows all 188 cognitive biases we have (click for higher-res version):

Questions:

- Chose 3 of the cognitive biases on the outside part of the circle (there are 20 of them) that you think you are most prone too.

- Give examples of times that these cognitive biases have crept into your thinking. Here are a few examples:

- We tend to find stories and patterns even when looking at sparse data: "I heard some friends talking about applying to ABC College, so it must be a "hot" college that I should take a look at."

- We imagine things and people we're familiar with or fond of as better. "My math teacher is incredible and definitely the best in the school and maybe even the whole city."

- Now think about a major future decision that you will be making (e.g., college). What are the potential cognitive biases that might impact how you make that decision?

- Now that you know about these cognitive biases, what can you do about them?

Here are four examples from the Visual Capitalist article about how cognitive biases show up in the business world:

Familiarity Bias: An investor puts her money in “what she knows”, rather than seeking the obvious benefits from portfolio diversification. Just because a certain type of industry or security is familiar doesn’t make it the logical selection.

Self-Attribution Bias: An entrepreneur overly attributes his company’s success to himself, rather than other factors (team, luck, industry trends). When things go bad, he blames these external factors for derailing his progress.

Anchoring Bias: An employee in a salary negotiation is too dependent on the first number mentioned in the negotiations, rather than rationally examining a range of options.

Survivorship Bias: Entrepreneurship looks easy, because there are so many successful entrepreneurs out there. However, this is a cognitive bias: the successful entrepreneurs are the ones still around, while the millions who failed went and did other things.

----------

Interested in how psychology impacts our financial decisions? Be sure to check out more Behavioral Finance posts from the NGPF Blog.

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS