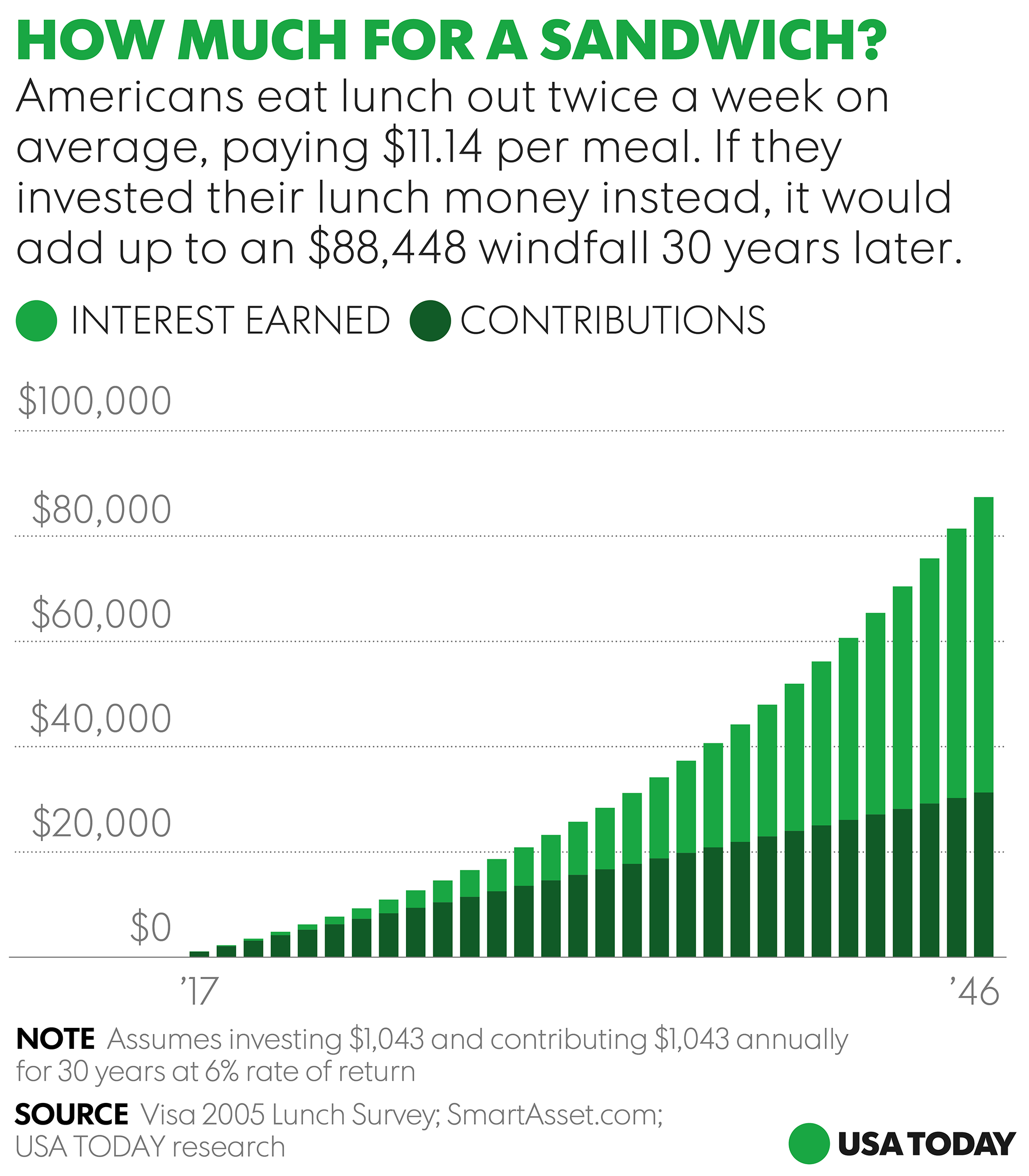

Do Your Weekly Lunches Cost You $90,000 in Retirement Savings?

“US households spent $3,008, or about $8.35 a day, on average, eating out in 2015… Investing $3,008 each year… would add up 30 years later to… more than $250,000. Similarly, investing $3.50 a day for 30 years instead of buying a latte would add up to savings of nearly $107,000”. (USA Today, June 2017)

_________

We all know that it is hard to save enough for retirement. Financial education teachers also know that students sometimes struggle to relate decisions in their current, daily lives, with how much they will need when they retire much later in life. This interesting article attempts to help close this inter-temporal gap by framing our current weekly spending choices in terms of equivalent dollar amount closer to retirement. “Is eating lunch out two times a week worth losing out on a potential investment windfall of $88,000?”

_________

Questions for Students:

- What information is contained in the chart? What is represented on the two axes? What is the difference between the different colored green columns on the chart?

- What is the reason for the “hockey-stick” growth visible in the light green columns in the chart? How is this connected with the advice to “save early and often for retirement”?

- How much does the average American spend on lunches per week? How do you think people may behave differently if they thought of this expense in terms of $88,000?

- What are some other expenses that people could potentially reduce if they thought of it in terms of equivalent amount of money in 30 years?

- Based on what you learned here, what would you advise a friend or relative, about daily spending habits? Why?

_________

Tips to Spend Less/Save More:

- Focus on the Small Stuff: “Small changes in your life can add up to a bigger nest egg,” says Francis Kinniry, principal at Vanguard Investment Strategy Group. “The key when it comes to saving is most people are thinking about the big things, like not going on vacation or not buying a new car. But it is really the little daily things that you do on a regular basis that can really add up.”

- Make Wiser Spending Decisions: Can you buy a smaller size or amount? Is there a cheaper alternative?

- Do You Really Need It? Is the item a need or a want? Are you purchasing the item out of impulse? What’s your motivation for spending?

- Do A Spending Audit: Study your purchases and look for patterns in areas where you can spend less. Use an app like Mint to monitor your budget and spending by categories.

_________

Want to Learn More:

Understanding opportunity cost in everyday decision making is a strong financial habit of mind. A penny saved is a penny earned, particularly with the power of compounding interest. We can help our savings for retirement and other life goals in the long-run, simply by making wiser daily spending decisions today.

Students can explore these savings decisions further through our activity, What If You Invested That Latte?

About the Author

Hari Vasu-Devan

As a young Indian immigrant, Hari was extremely privileged to learn about financial literacy by way of his parents....

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS